Now the largest sector of Agricole's service and the most important service to its clients. This is how clients make, and limit losing, revenue/ margin from trading in the very volatile combinable crops market. Clients are trying to make sense of the commodity markets, when every year is different.

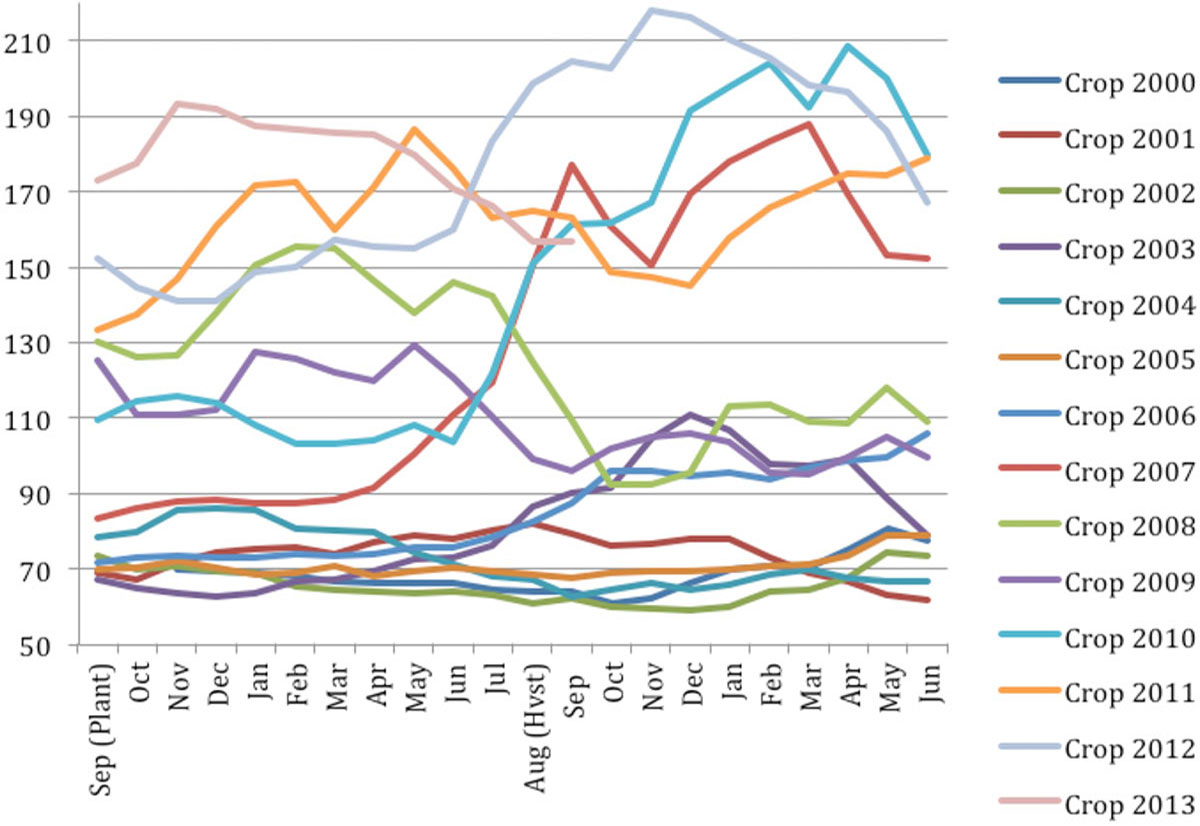

Please see the graph below of the last few years' wheat price fluctuations. Who can second guess these?

An individual service, based on the clients own minimum required £/t, to make a living, 'The Standard of Living Line', SOLL. This is higher than a break even price. Using this SOLL, a budget is created from the client's own need for cashflow and storage space. Crops are sold above the SOLL, with some sort of Price Risk Management hedge added.

Crops are sold up to two harvests ahead. When there is a Futures price there is an ex-farm price.

Your crop is hedged, using forward physical contracts or minimum price contracts to manage the effect of the volatile price movements on their income. This takes the emotion out of trading and separates the market from your business needs. Agricole's aim is to ensure that whatever decision is made, on whichever day it is made, that the top 1/3rd of all prices from the 30 month marketing season are realised.

The maximum loss possible is the premium to buy the minimum price contract, the price of which varies from season to season and the time covered.

Please see the graph below which illustrates how minimum price contracts reduce the effect of volatility of the market.

Storage and Minimum Price Contracts

Why do you store grain for long periods? Many times it is not worthwhile. Contact me for an explanation of how minimum price contracts can help you save money and reduce hassle. You don't need grain in a shed to take advantage of a price rise.

Contact us for more information.

WHAT OUR CLIENTS SAY

“Just a thank you to both you and Robert for sorting out the barley regarding moisture and redirection. Thanks!”

Tim Scott, M. E. J. Scott & Son, Cambs“Out of all the reports I read, or rather receive from various grain merchants, yours is the most readable, being concise, factual and relevant.”

John Young, Ringstead, Norfolk“Agricole offers me 24/7 access to an unbiased overview of the markets in which I am interested, both in the long and short term. I am free to do as much or as little busines as I wish, and always feel that the service is provided to benefit my particular position.

The information I receive has the farmer’s interests at heart, and a solution is usually found to help me in what I am trying to acheive. The service is both professional and personal, and I would say that the service now lies at the heart of my grain marketing strategy.”

Nick Rowsell, John Rowsell Ltd, Winchester“I find it very refreshing to use a service which is completely unbiased and where all costs are agreed “up front”. In the last few years, the use of options has certainly protected my turnover from the volatility in the market and I am extremely satisfied with the results.”

Gavin Lane, A.G.A. Lane, Kings Lynn“I came across Jeremy’s services when he delivered a presentation to one of the discussion groups I’m involved in. I found his independent views very refreshing and see them as essential in ensuring our business maximises its returns. His service saves me time in that I no longer have to phone round numerous traders as this is what he does, only far more efficiently.”

Andrew Randall, Randall Farms, Berkshire“Agricole has been a beacon of hope to many farmers who have persevered in growing crops (as they believe they should) amidst all the uncertainty of globalisation and constraints by non-market forces including enviromental groups, politicians, etc.”

Robert Bruce, Cambs“Thanks for latest bad news ! At least it is what I have been expecting. I cannot see any improvement in prices till this time next year, hence I completed selling 2011 crop two weeks ago which means it will rise now!

Have sold 30% of ’12 wheat crop (AV. £150 Aug/Nov) and building storage to hold the rest, but will keep selling if it comes back above £150. 15% rape sold £350 AA and 20% Malting barley £175. Your reports still the best read of the week.”

Alister Borthwick, Deepdale Farms, Norfolk“Thank you for the excellent grain reports during the season – which help very much with marketing our grain. Knowing what has happened around the world, who is buying what and how other people’s harvests are going is a very useful tool.”

George & Dan Crook, Aughton Farm, Wilts“I have constantly been satisfied with the price and service from Agricole.”

Stuart Watt, Lincolnshire“Jeremy’s reports are the best of the lot. Particularly now he’s giving more predictions of the future, he gives lots of guidance.”

Richard Allan, Rugby“I thought the course was excellent and because it was quite intense it actually helped my overall understanding of the subject and certainly got me thinking about what we should be doing.”

George Rees, Rees Farming, Hampshire